Looking at summer? All good. Looking beyond? Not so much.

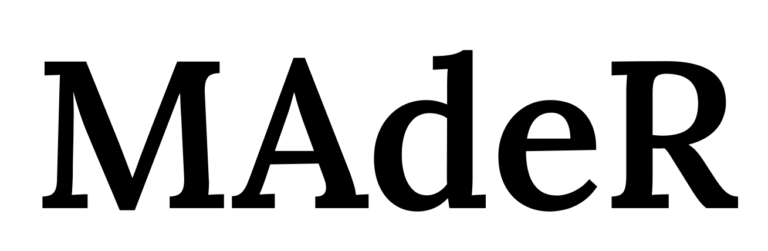

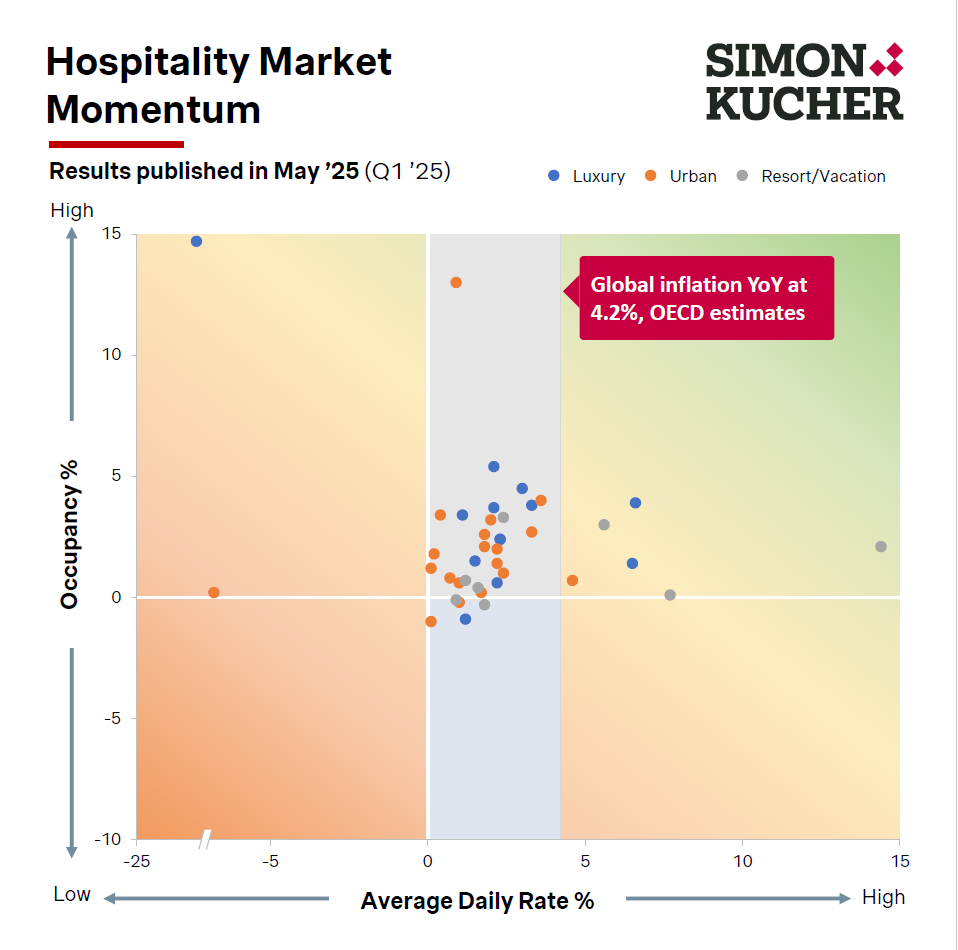

Tourism is in good shape heading into the season. Occupancy and ADR are up pretty much everywhere. As usual, at Simon-Kucher we’ve gone through every listed hotel group’s earnings. And yes, things look solid.

But look again at the charts, and a few things stand out:

– ADR growth is already trailing inflation in most cases. Makes sense: we’ve seen strong rate hikes for the last few years. That momentum is slowing down.

– Urban travel is starting to show signs of softening compared to leisure and luxury. Early signal?

And if you look past the charts altogether, and without being exhaustive, you will find:

– A tourist paying record prices for the same “old” holiday in the same “old” place.

– Weak (pandemic) consumer confidence, either due to geopolitical instability or bundled with shrinking purchasing power.

– Overcrowded destinations increasingly filled with lower-spending visitors, more exposed to economic ups and downs.

-…and more.

When you listen to what most hotel executives are saying, it all fits. They’re watching closely what happens after the summer.

Because when summer ends, we’ll open the box and see whether Schrödinger’s tourist is still alive…or just checked out.

On our analysis:

We periodically analyze the reports of virtually all publicly traded hotel and restaurant brands covering every available market segment. Our research spans stock exchanges worldwide—from New York to São Paulo, including Madrid, Oslo, Mexico, Thailand, and the Philippines.