We did. Just (personally) not this bad.

Last quarter, consumer confidence was in free fall, and organic sales across listed restaurant brands were already losing steam. The outlook wasn’t promising.

What didn’t we expect? The added blow from tariff threats. Not because of a price surge – but because of the extra dose of uncertainty injected straight into the consumer mindset.

Even store openings, last quarter’s lifeline, couldn’t turn things around.

Growth in Q1 depends almost entirely on expansion… and that’s clearly not cutting it.

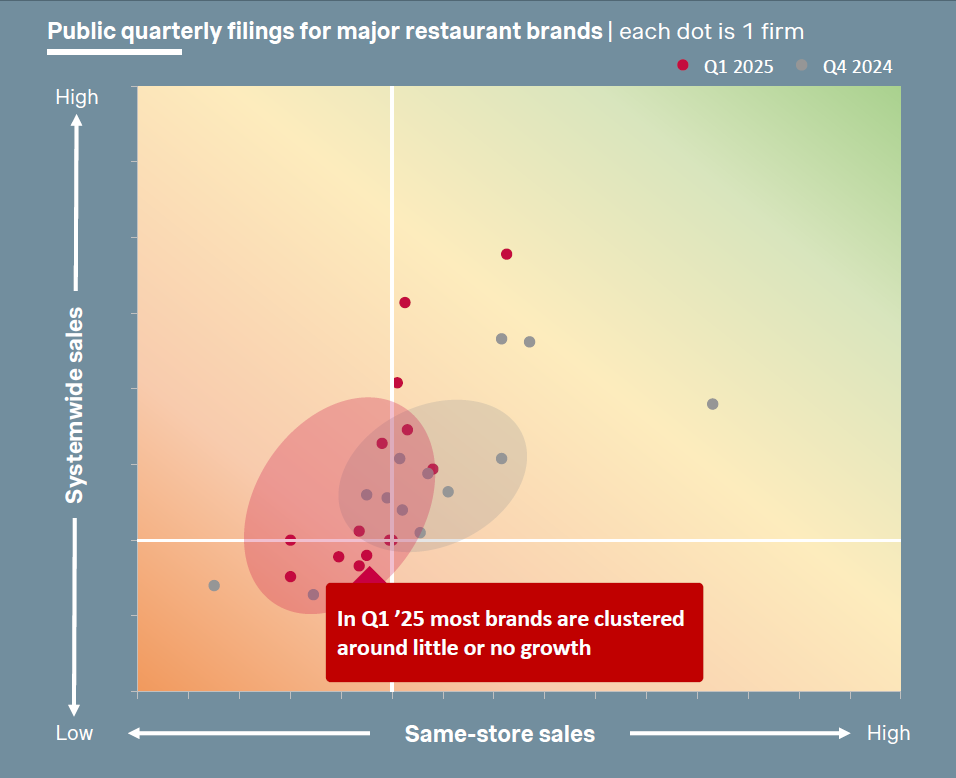

As I did last quarter, I’ve plotted Same-Store Sales (SSS) and Systemwide Sales (SWS) performance for every listed brand. Two things stand out:

• In slide 1/2, I’ve marked where most brands are clustered – and it’s not a pretty picture. Q1 ’25 looks worse than Q4 ’24, with too many brands flatlining or shrinking.

• In slide 2/2, you’ll see the quarter-on-quarter trend. The steeper the line, the greater the reliance on new openings to deliver growth. That slope speaks volumes.

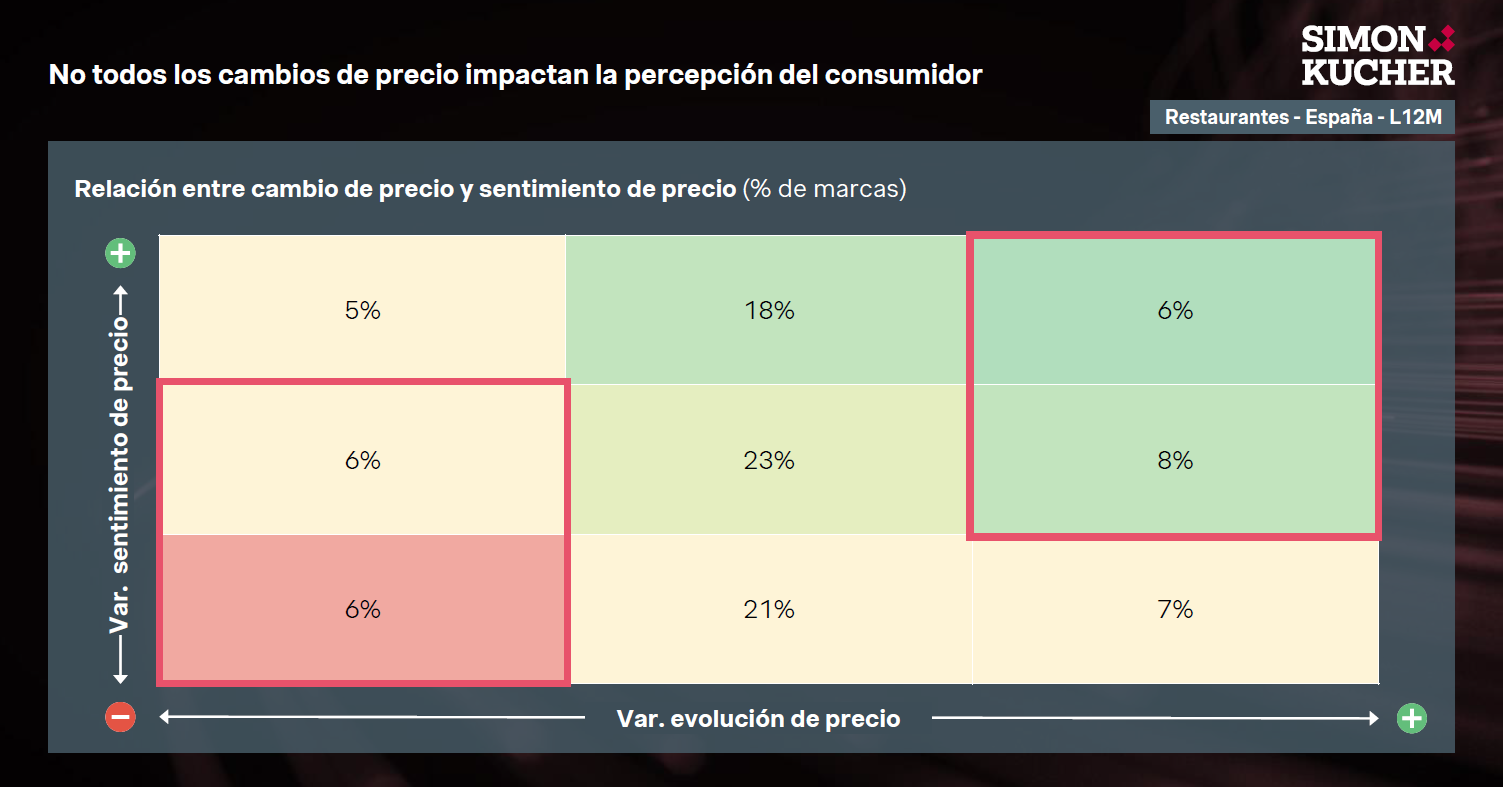

Let’s be clear: this isn’t about purchasing power – it’s about uncertainty.

Consumers aren’t more elastic. They need a reason to spend. That reason won’t come from pushing more promos. It will come from rethinking affordability.

Until then, we’ll keep watching millions evaporate in unnecessary discounts.

#commercialstrategy #pricing #restaurants #tariffs

*This article is my own, not ChatGPT’s. It was written with time, care, and data. We periodically analyze the reports of virtually all publicly traded brands covering every available restaurant segment. Our research spans stock exchanges worldwide – from New York to São Paulo, including Madrid, Oslo, Mexico, Thailand, and the Philippines.